philadelphia wage tax for non residents

What is the Philadelphia city Wage Tax for residents. Non-resident employees who had City Wage Tax withheld during the time they.

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

On May 4 2020 the Philadelphia Department of Revenue updated its guidance for withholding the Wage Tax from nonresident employees who are working in the city temporarily due to COVID.

. All Philadelphia residents owe the City Wage Tax regardless of where they work. These are the main income taxes. Only non-resident employees are eligible for a Wage Tax refund for work performed outside of Philadelphia.

The city of Philadelphia increased its wage tax rate for nonresidents to 35019 from 34481 effective July 1 2020 the citys revenue department said on its website. Relief from the wage tax may be good news to suburban residents but it will add to the already damaging impact of the pandemic on the citys finances. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident and non.

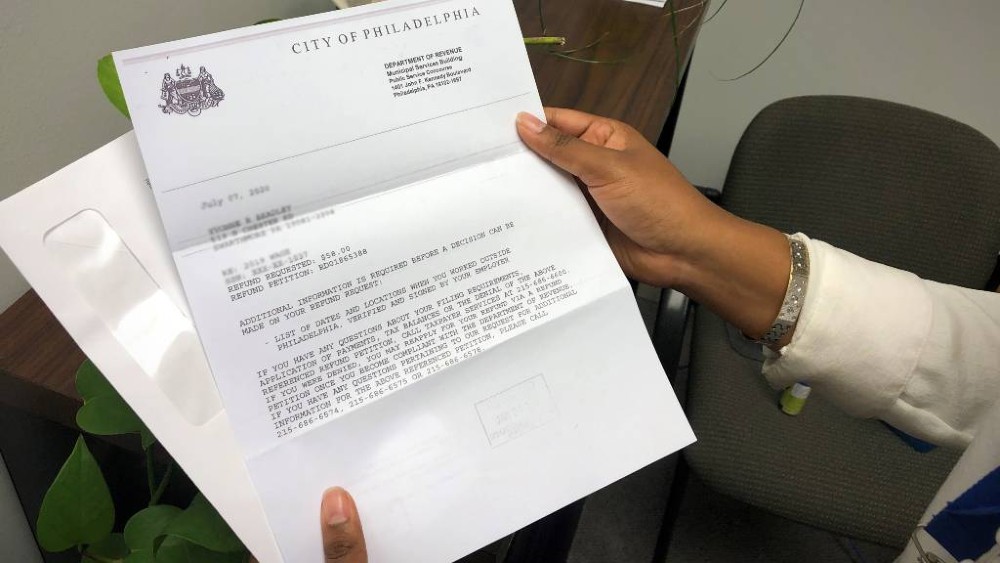

File a Non-Resident Covid Ez Refund Petition with the Philadelphia Department of Revenue. See below to determine your filing frequency. If your employer REQUIRES you to work.

A non-resident who works in Philadelphia and doesnt have the City Wage Tax withheld. Remember you will not receive a refund unless your employee signs the form. Philadelphia Wage Tax For Non.

Resident employees are taxable whether working in or out. The City of Philadelphia announced that effective July 1 2021 the Earnings Tax rate for nonresidents is 34481 down from 35019 and the rate for residents is 38398 a. The Wage Tax must be filed quarterly and paid on a schedule that corresponds with how much money is withheld from employees paychecks.

Tax rate for nonresidents who work in Philadelphia. For residents of Philadelphia or 34481 for non-residents. The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate.

The wage tax which. Effective July 1 2021 the rate for. Philadelphia imposes a Wage Tax on all salaries wages commissions and other compensation received by an individual for services.

Non-residents who work in Philadelphia must also pay the Wage Tax. On the other hand if a Philadelphia employer requires a non-resident to perform duties outside the city he or she is exempt from the Wage Tax for the days spent fulfilling that work. Beginning on July 1 2021 the City of Philadelphia will lower the rates of its Wage Tax and Earnings Tax for both resident.

While Philadelphia residents are eligible for refunds of City Wage Tax if they paid tax to other. The City Wage Tax for Philadelphia residents is 38712 and 35019 for non-residents. Non-resident employees who had Wage Tax withheld during the time they were required to perform their duties from home in 2020 can file for a refund with a Wage Tax.

Since July 1 2021 the Philadelphia resident rate is 38398 and the non-resident rate is 34481. PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes. Nonresident employees who mistakenly had wage tax withheld during the time they were required to perform their duties from home.

What Is Philadelphia City Wage Tax. The table below lists the local income tax rates in some of the states biggest cities. City residents have to pay 38712 and non.

Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the. Non-resident employees who had Wage Tax withheld during the time they were required. City Wage Tax is imposed on all the wages for Philadelphia residents whether they work inside or outside of the city and on non-residents when they work in Philadelphia.

City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation. All Philadelphia residents regardless of. Employees who are non-residents of Philadelphia and work for employers in the city are subject to the Philadelphia Wage Tax at a rate of 35019.

Normally Philadelphia non-residents employed in.

City Of Philadelphia Announces Wage Tax Rate Increase For Non Residents Starting July 1 2020 Wouch Maloney Cpas Business Advisors

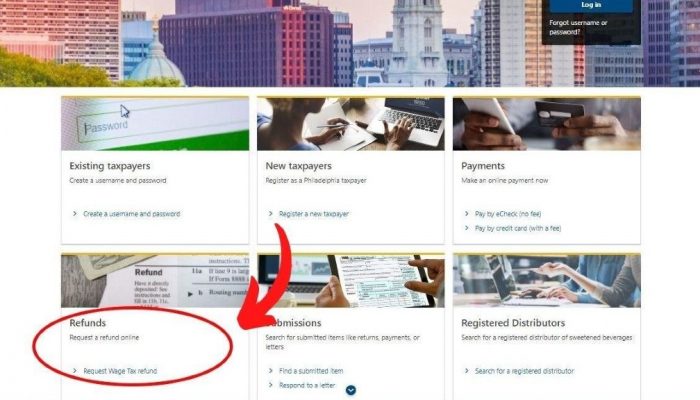

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

![]()

Philadelphia Wage Tax Refunds Reboot For 2021

Philadelphia City Council Unveils 5b Budget Whyy

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

Jesus Phillytax Is 4 Harrisburgtax Is 2 Why Earth Instagram Posts Instagram Snapchat

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Over 42 000 Philadelphians Use New Online Tax System On Top Of Philly News

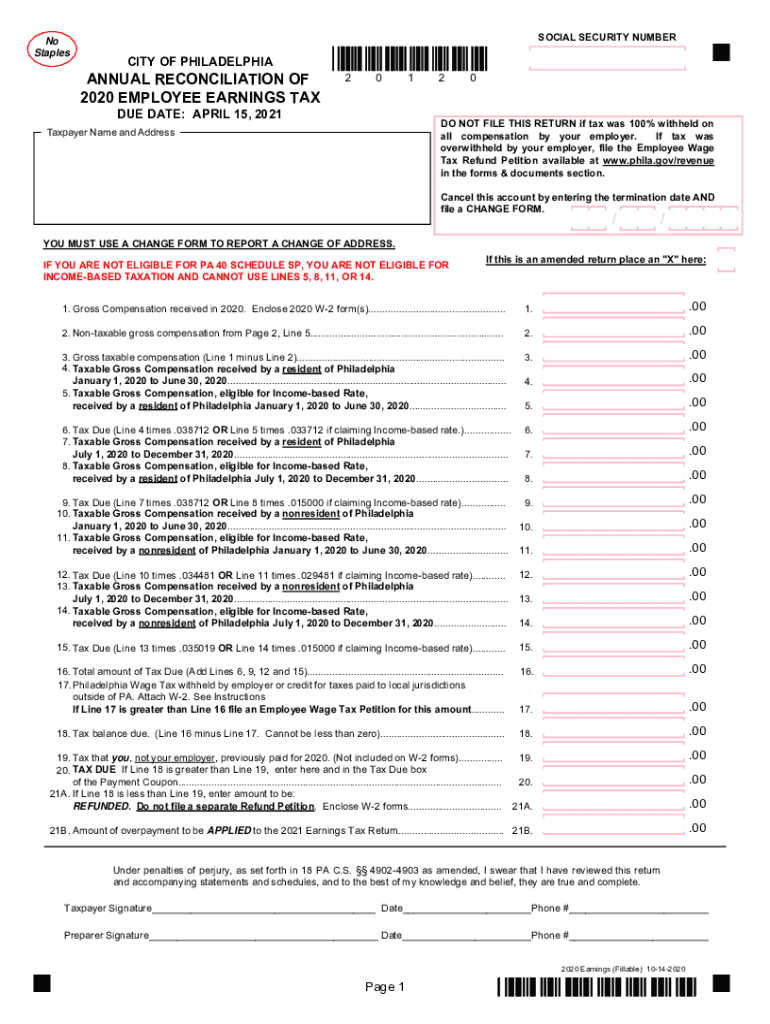

Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Fill Out Tax Template Online Us Legal Forms

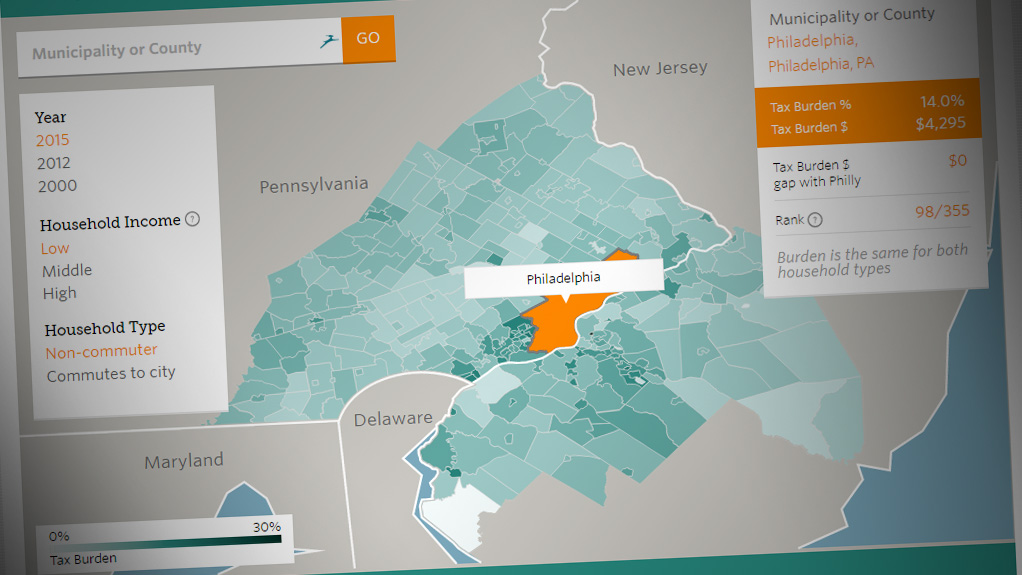

Comparing The Tax Burden In Philadelphia And The Suburbs The Pew Charitable Trusts

Philadelphians Who Work Outside Pa Could Be Eligible For Wage Tax Break Whyy

2020 Philadelphia Tax Rates Due Dates And Filing Tips

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

When Are Non Residents Exempt From Philadelphia S Wage Tax Department Of Revenue City Of Philadelphia

City Announces Wage Tax Reduction Starting July 1 2017 Department Of Revenue News City Of Philadelphia

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton

Philly Budget Wage Tax Shrinks Anti Violence Spending Up Whyy